can i pay for a car with 529 distributions

can i pay for a car with 529 distributions

Publication 529 (2012), Miscellaneous.

First of all, I am not claiming to have invented this trick. I imagine others have used it with varying degrees of success. I also want to point out t

You can deduct the costs of operating your business. These costs are known as business expenses. These are costs you do not have to capitalize or include in

You can usually borrow to finance a college education - regardless of credit rating or income level - but the same is rarely true for funding your retirement.

What Can I Write Off as Startup Expenses?.

Cruises You Can Pay On

On Thursdays, CPA and Vice President of Corporate Tax Network, Gary Milkwick and his team, answer tax questions for free on the LegalZoom Facebook Page.

How I got an uncooperative eBay buyer to.

Need a loan to pay off debt? See if you qualify for relief without a loan

Cash Flow Management Learning Module. Click here to visit our interactive learning module on cash flow management. This tool will walk you through the strategies and

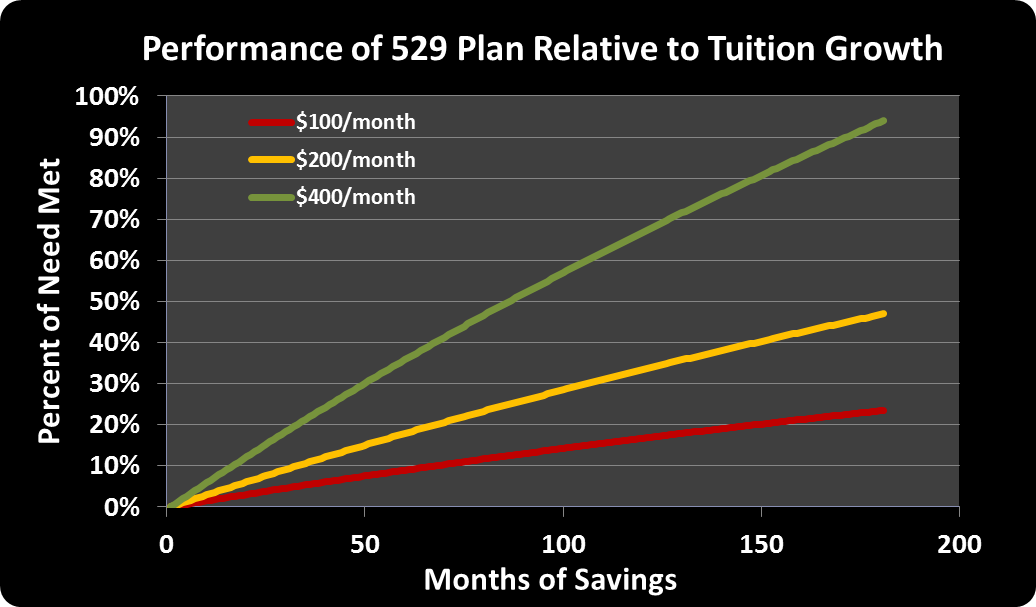

The intent in taking distributions from a Section 529 college savings plan is to pay college expenses in the year they are incurred. Continuing to contribute to a

Vacations You Can Pay On Use 529 plan to pay off college loans?.

can i pay for a car with 529 distributions

Pay For A College Education With. Welcome: Small Business Online CommunityHow Can I Lower My Income Taxes?.

You can deduct certain expenses as miscellaneous itemized deductions on Schedule A (Form 1040 or Form 1040NR). You can claim the amount of expenses that is

.